Olivier Primeau Prime Drink Group: Built on Hype, Not Cash Flow

Let’s talk about Prime Drink Group. My interest started when I noticed that Olivier Primeau is one of the founders and a pretty famous person in Quebec. For people not living in Quebec he is kinda like a Dave Portnoy lite. The reason I dislike him is that he is trying to pump his stock to retail investors with little knowledge about the stock market. The only thing that might save them is their water rights, but I will talk about that later in this post.

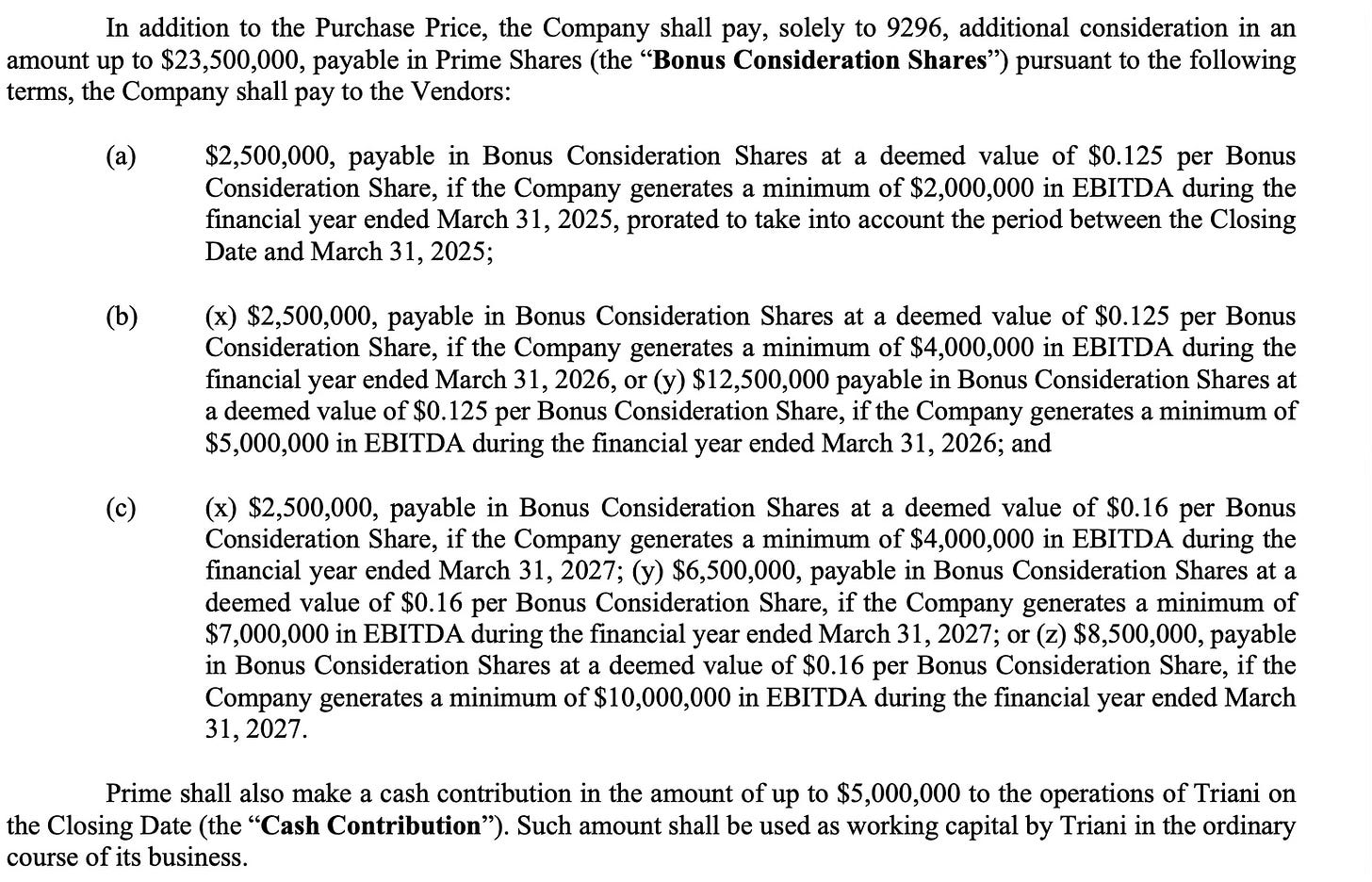

Let’s start with one of the worst acquisitions: the Triani group. It was acquired in October 2024, and they renamed it Prime Bottling. They mostly produce alcoholic like non gluten beer and non-alcoholic products in North America. Triani also exports some of its products south of the border. You want to know how much they paid for the business? Here’s the number: $11,400,000 payable in common shares of Prime at a deemed price of $0.125 per share. It also has some performance earn-out, but that will be valued at zero it was contingent on an EBITDA number. The company did $28 million in sales for $4.4 million in EBITDAfor the year 2023, which means a price of 2.5x EBITDA. In 2024, the loss went to $12 million and sales were down to $16 million. Those results and the debt of $54 million mean that the company is now facing a receivership application filed by its main creditors. The odds of a liquidation with this much debt are pretty high in my estimation. I don’t understand the rationale behind the acquisition, but it seems pretty bad to issue stock at a low price for a company that doesn’t have a moat and could have been built with the $11 million in capex instead of the acquisition. But what do I know? I’m not the Chief Acquisition Officer of Prime. Also, don’t forget that the people who ran Triani are not the ones with the greatest integrity, and they are now suing each other because Prime Group fired them, but they got reinstated.

Here are some exhibit of the company proxy circular and the most recent M&DA about Triani.

This is what they would pay if the EBITDA target were in line for 2025 you get EBITDA at 2 million, but in 2023 it was at 4.4 million. Where’s the logic in that? Paying for a lower EBITDA number makes no sense. For me, the objective there seems too easy to get.

In the next photo, you can clearly see that the company is not in good shape liabilities are greater than assets, which is never where you want to be unless the acquirer has some firepower to turn things around. But Prime Drink Group doesn’t have that kind of firepower, and we saw how it played out with Triani landing in receivership.

Triani acquisition come with warning about their lenders saying that they have an agreement that could lead to a default not the greatest start!

Here some link about the Triani saga by the media in Quebec. LAPRESSE, We have also learned that the company has lost their federal permit to brew alcohol.

Recently, they also bought out a 70% stake in Relax Downlow, a new sleeping drink, for $255,000 in stock issuance and $95,000 in cash for 70% of the company. Now wait, from who did they acquire the company? DING DING DING no surprise, it’s an employee of the company. So, another related-party transaction. Looks like life is good if you get acquired by Prime, but the dilution is insane at those valuations even if the market cap is at 41 million. I understand when tech companies do it, but this is no way to treat your partner the shareholder. That just proves the management have never run a public company before, because they would know that cash flow is king and one of the few metrics that actually matters in the long run. They also brought in two Montreal Canadiens stars, Lane Hutson and Ivan Demidov, to promote the product both of them probably cost something like $30,000 Canadian on the high end. The product is only available in the convenience store Couche-Tard (Circle K). We still don’t have any forecasts about sales or if this will ever be profitable. Quick note: you won’t get rich while diluting a company it just makes everyone poorer.

The acquisition marks Prime's entry into the growing functional beverage market, projected to reach $1.3 billion by 2030.

Look at what they said in the press release. DING DING DING we got the TAM buzzword, like many companies in 2021 used it so they could boost their valuation while not talking about the bottom line.

Let’s now talk about the Prime Media asset acquisition for $2.5 million that happened on November 26, 2024. How did they pay for this acquisition? With CAD 1 million in shares, $250,000 in a cash lump sum, and a $1 million promissory note payable in 24 equal monthly installments of about $41,666.67. Another third-party acquisition and we still don’t know what kind of revenue this media agency actually generates. What I’d really like to know is whether they’re billing properly for work done with other Olivier Primeau ventures, like Beach Day Every Day, which is the one bringing in the most sales not yet in the Prime drink corp group. Is he really doing what’s needed to drive revenue at Prime Media and deliver shareholder value? My guess is no. Below, you can see a promo post for Beach Day Every Day did the company pay for that social media exposure, and how does that cost compare to a regular agency?

Now let’s move on to the one thing that could save the company the water rights. They control access to 3.35 billion liters annually, and this is the big asset they’re trying to monetize. They’re actively lobbying the government to change the current framework because, as it stands, they’re not making much money from it. But here’s the issue, I think the water story is overhyped. Just look at Israel they’re producing drinkable water from the ocean at a relatively low cost. Cheap water in Quebec should be used as a tool to attract businesses and create jobs, not as some pet project. Water will never be like petrol we won’t ship water oversee with a big boat. We will learn more about their plans in the coming months, but don’t count on this to bail them out. You can read another substack about water here.

Prime Drink Corp wants to buy other assets like BDED and the distribution division for a pretty big number, which means more dilution ahead since they don’t have any cash on hand to fund those acquisitions. That’s why, for now, those businesses aren’t part of the company, but it’s important they eventually are, because BDED is the one generating the most cash flow. As of now, it’s still sitting under an unconditional LOI, with no clear timeline for when or if the deal will close.

The management compensation is pretty standard no big problem on that front with the CEO making 130k per year.

What the company need to do for good return in the future is simple they need to demonstrate that Prime drink group will stop diluting current shareholder. Since 2024 share count has increase 145% from 144 million share to 353 million. Improve the investor relation department about what they will do the story is too difficult to know even for someone who read all the filling and follow Olivier Primeau. The other thing is they need to prove they can generate cash flow to become sustainable or a path to it, so the share can go back up. Third one would be to read the book : The Outsiders : Eight Unconventional CEOs and Their Radically Rational Blueprint for Success because we see that they have never run a public company. Remember all the odd of success will come from the water right division that the government of Quebec might change. Olivier Primeau is a really talented marketer there is no doubt about, but the stock market is a rutless place that can humble you very quick if you don’t have a plan, and it looks like that so far at Prime drink group corp.